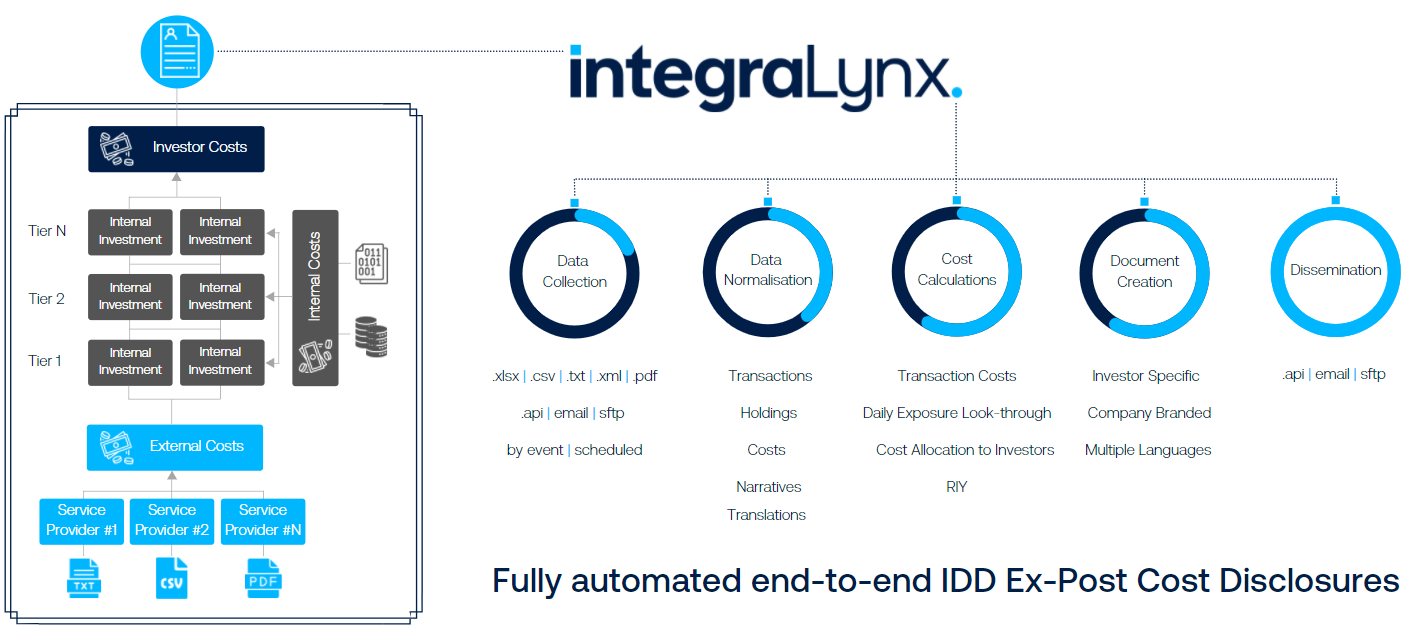

The IntegraLynx | IDD Cost Disclosures Engine enables insurers to consume large-scale datasets from various sources, perform cost calculations, and allocate those costs on a look-through basis through multi-tier investment hierarchies to client accounts.

The ouptut is company branded IDD Ex-Post Cost Disclosures ready for dissemination.

IntegraLynx delivers an end-to-end automated solution, in one platform. Reducing operational risk, and helping your organisation to meet regulatory requirements in a timely manner.

Our solution seamlessly complies with the EU’s regulation on IDD (Ex-Post Cost Disclosures). Insurers selling investment products are obliged to produce an annual document to illustrate costs incurred by investors on an ex-post basis.

This presents a significant data engineering challenge to insurers. They must gather cost data from multiple internal and external data sources, combine this data with investment holdings (often involving multiple tiers/levels), then calculate the costs incurred by each individual investor. Ultimately, this involves processing millions of rows of data and creating investor-specific disclosures - potentially in multiple languages.

Example statistics from one Reitigh client:

+20 million

Rows of data

18,000

Annual Client Disclosures

10

Languages

IntegraLynx Features

IntegraLynx is our purpose-built platform designed to solve complex challenges, accelerating decisions and defusing ambiguity to transform legacy systems and empower the automation of processes across financial services.

Privacy | Modern Slavery Statement | © 2024 Reitigh