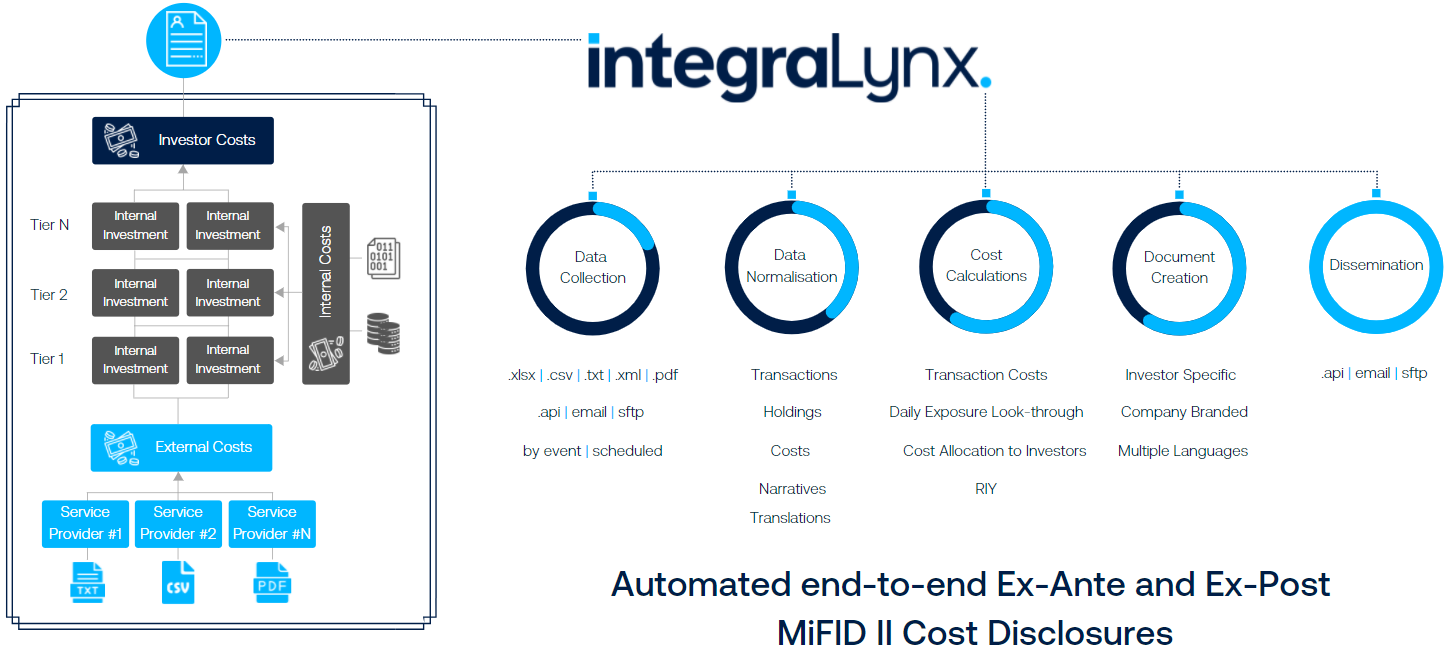

IntegraLynx expedites the processing challenges for distributors and financial advisors associated with Cost Disclosures for the Markets in Financial Instruments Directive (MiFID).

IntegraLynx delivers an end-to-end automated solution, in one platform. Reducing operationaly risk, and helping your organisation to meet regulatory requirements in a timely manner.

In seeking to improve the competitiveness of the EU’s financial markets by creating a single market for investment services and activities with harmonised protection for investors, MiFID II presents an extensive processing challenge resulting from the vast amount of data sourced from both internal and external systems.

IntegraLynx fully automates and audits MiFID II (Ex-Ante and Ex-Post) Cost Disclosure processes for data collection, regulatory calculations, and document creation, all in a single powerful application.

IntegraLynx Features

IntegraLynx is our purpose-built platform designed to solve complex challenges, accelerating decisions and defusing ambiguity to transform legacy systems and empower the automation of processes across financial services.

Privacy | Modern Slavery Statement | © 2024 Reitigh